Some Known Factual Statements About Lamina Loans

Table of ContentsWhat Does Lamina Loans Do?Getting My Lamina Loans To WorkThe Greatest Guide To Lamina LoansThe Main Principles Of Lamina Loans Little Known Facts About Lamina Loans.

The large difference between a credit report card and also an individual financing is that the card stands for rotating financial obligation. The card has a collection credit score restriction, and also its owner can repeatedly borrow money up to the limit and also settle it over time.

As an outcome of changes in the 2017 Tax Obligation Cuts and Jobs Act, interest on a residence equity loan is now just tax insurance deductible if the money obtained is used to "get, build, or considerably enhance the taxpayer's home that protects the financing," per the Internal Profits Service (IRS). The greatest possible downside is that your home is the security for the loan.

Facts About Lamina Loans Uncovered

The proceeds of a residence equity funding can be made use of for any type of objective, yet they are typically made use of to update or expand the home. A customer considering a home-equity funding might maintain in mind 2 lessons from the economic situation of 20082009: Home values can decrease along with up.

(HELOC) functions like a credit report card yet makes use of the home as collateral. A maximum amount of credit is expanded to the debtor.

Unlike a regular home-equity lending, the interest price is not set at the time the finance is authorized. As the consumer might be accessing the cash at any type of time over a period of years, the interest price is commonly variable. It may be pegged to an underlying index, such as the prime price.

Throughout a period of increasing prices, the rate of interest costs on an impressive balance will certainly raise. A house owner who obtains money to set up a new kitchen area and pays it off over a duration of years, for example, might obtain stuck paying a lot more in interest than anticipated, even if the prime price went up - Lamina Loans.

Our Lamina Loans PDFs

To take one example, the rate of interest price for a cash breakthrough on the Chase Freedom bank card is 29. 99%. Cash loan also include a charge, commonly equal to 3% to 5% of the advance amount or a $10 minimum. Worse yet, the money development goes onto the credit rating card balance, accumulating rate of interest from month to month up until it is settled.

If the missed repayment is an unusual occasion, you may have the ability to call the client service line and request that the fees be returned and the rates of interest continue to be the very same. It will certainly depend on the customer care agent, but you may locate clemency. Lamina Loans. Obtaining cash is merely component of life for numerous people, but how you obtain cash as well as just how much you pay for the privilege differs extensively.

Those with greater ratios usually have a reduced chance of authorization. Lenders may assess this info by asking for your bank declarations.

The Only Guide to Lamina Loans

When it concerns applying for a funding, keep in mind that every loan provider's procedure is different. That being stated, these are the basic steps you need to take when getting an individual finance: Find the ideal lender by comparing attributes, amounts, rates of interest, terms, consumer reviews, etc. Pick the lender that ideal fits your demands.

You'll be required to provide details such as: Call, Get in touch with information (address, phone number, email)Employment info (where you function, your task title)Revenue details (pay stubs, or financial institution statements to my company prove direct deposit amounts)Wait to click here for more hear back from the loan provider. This can take anywhere from a pair of hrs to a pair of days.

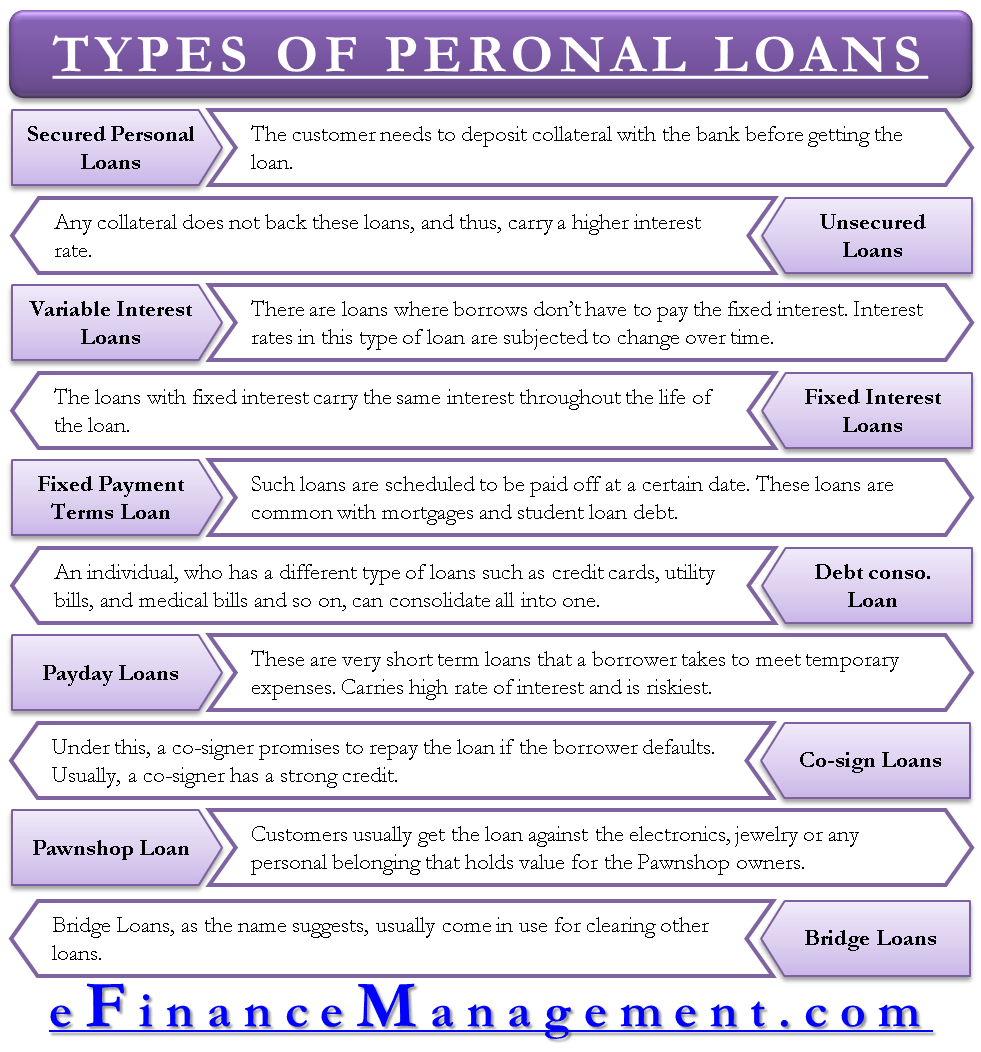

Receive your finance arrangement, reviewed via it very carefully, and also indication on the dotted line. There are several different types of individual loans you can apply for.

One means of comforting them is by supplying up one or even more properties as payment in case you default on your settlements for as well long. While doing this frequently gives you a far better possibility of being authorized for a huge lending and a reduced rate of interest to go with it, be extremely mindful.

6 Easy Facts About Lamina Loans Described

Implying if you back-pedal the loan, the loan provider may charge you charges or sell your financial debt to a debt collector, yet it can not take any of your assets to recoup repayment. Given that unsecured loans don't include security, the rate of interest you get is likely to be greater than that of a safeguarded loan.

If you have bad credit or poor financial resources as well as are not able to get an individual loan, then you ought to think about getting a cosigner. A co-signer is an individual that consents to take obligation for the lending in case you skip. A co-signer is normally a person you understand such as a relative or good friend, nonetheless, they have to have excellent credit and finances to be approved by the lending institution.

These loan providers have actually flexible needs compared to even more traditional economic organizations like financial institutions. Some best site individual loan lenders do not need credit report checks, they simply base your eligibility on your overall monetary wellness. It's crucial to keep in mind, that these loan providers often charge greater rate of interest prices, making them a more costly alternative.

Once it's been approved, you'll pay that exact same rates of interest, meaning it won't boost or lower for the duration of the funding term. This kind of rate can be advantageous since it never ever fluctuates, making it simpler to budget plan. A variable price, on the various other hand, is mosting likely to rise and fall in accordance with the current market premium, otherwise called the "prime price".